Key Takeaways

- Booking.com is the OTA to beat when it comes to Google Ads.

- TripAdvisor may be in trouble, creating a window of opportunity for smaller hotels and resorts.

- Hotels.com is largely absent from the paid media marketplace, but their strategy may emphasize organic traffic anyway. They’ve also made a play to reach engaged couples who are rescheduling their big days.

- Like Hotels.com, Expedia seems to emphasize organic traffic. Their CEO is also foreshadowing their departure from Google and performance marketing.

Online travel agents (OTA’s) are the primary digital competitors for most hotels and resorts. These are the domains most properties resent seeing at the top of the search engine results page (SERP), especially if their presence is stealing impression share on terms valuable to your property. As bulletproof as OTA’s seem to be, they aren’t immune to the effects of COVID-19.

They, too, are revising their ad spend and seeing fluctuations in impression share and clicks to their various domains. With April and May in the rearview, we can see that the crisis has impacted each OTA differently.

The OTA Landscape

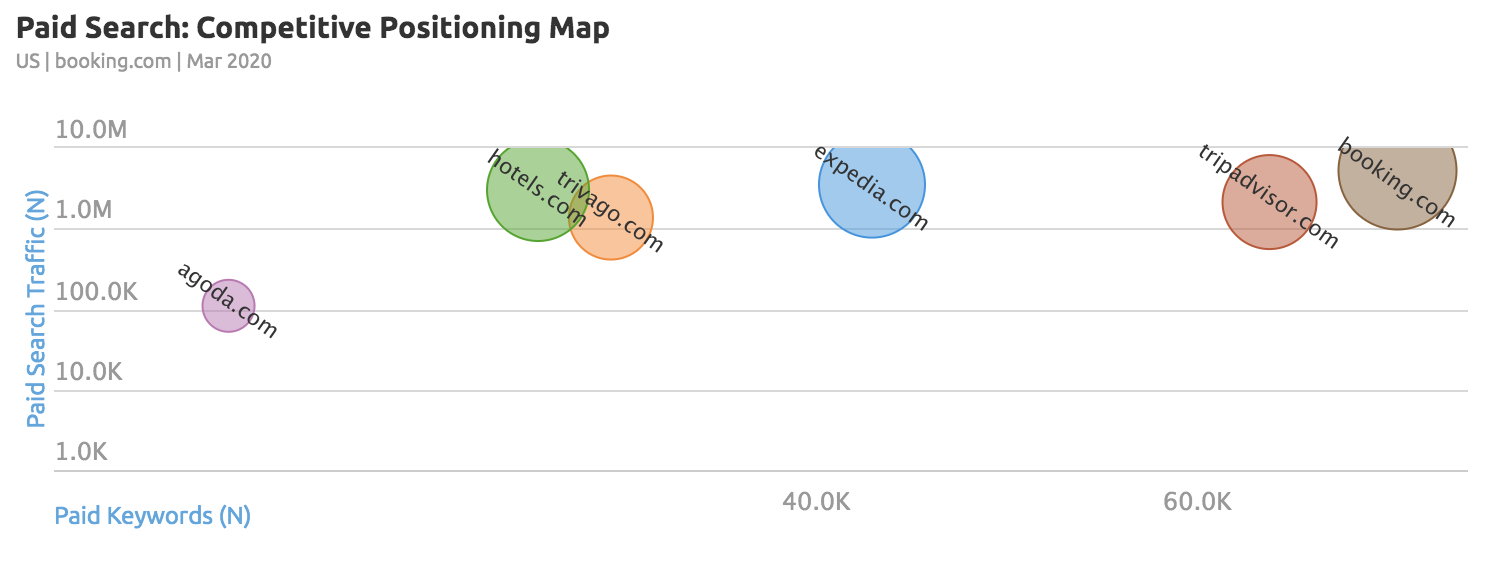

Given that these are paid traffic trends, the differences can likely be traced back to the differences between each OTA’s appetite for ad spend. Bookings.com is seeing an increase in paid traffic, with traffic rebounding to the levels they were in March. Other OTA’s are displaying near radio-silence when it comes to paid traffic.

Source: SEMrush

Organic traffic is a different game, and the OTA field is playing out entirely differently. Other brands can’t hold a candle to TripAdvisor. But booking.com actually falls close to the bottom of the pile of organic traffic, while Hotels.com and Expedia seem to hold their own.

Source: SEMrush

When it comes to the field of OTAs in paid search, Booking.com seems to be the brand to beat for OTAs and hotels alike. If we look at the competitive positioning map for the current month (May 2020) compared to March 2020, we can see that booking.com is one of the few who’ve maintained both the number of paid keywords they’re bidding on, and, consequently, the amount of paid traffic they’re driving to their site.

Source: SEMrush. Competitive Positioning Map for March 2020.

TripAdvisor, Expedia, and Hotels.com fell off the map completely, and have been replaced by lesser-known OTAs like reservations.com and luxuryhotelsguides.com. The silver lining of this is that even the OTA landscape in paid media is less cluttered than it was before, giving smaller hotels and resorts the opportunity to capture more impression share, possibly for less spend.

Source: SEMrush. Competitive Positioning Map as of May 21, 2020.

Given the differences in strategy between each OTA, for May’s OTA review, we’re breaking down the estimated traffic cost, keyword differences, and the representation of paid vs organic traffic for four OTA heavy hitters: Booking.com, TripAdvisor, Hotels.com, and Expedia.

Booking.com

Booking.com is the brand to beat in Google Ads. They’ve maintained a higher level of ad spend than other OTAs, and therefore are receiving more paid traffic.

There are a few things to note here. The first is that the value reflected below is traffic cost, not ad spend. Traffic cost is a metric SEMrush estimates by multiplying the number of keywords they’re bidding on against historical CPC and CTR for the entire U.S. So while the actual cost reflected below may not match the total spend we might find in their Google Ads accounts, what’s important is the trend line.

Over the past month, the traffic cost for booking.com increased by 285%. Likewise, their paid traffic increased by 219%. Though these may not be back to pre-coronavirus levels, the increase is worth noting.

Source: SEMrush

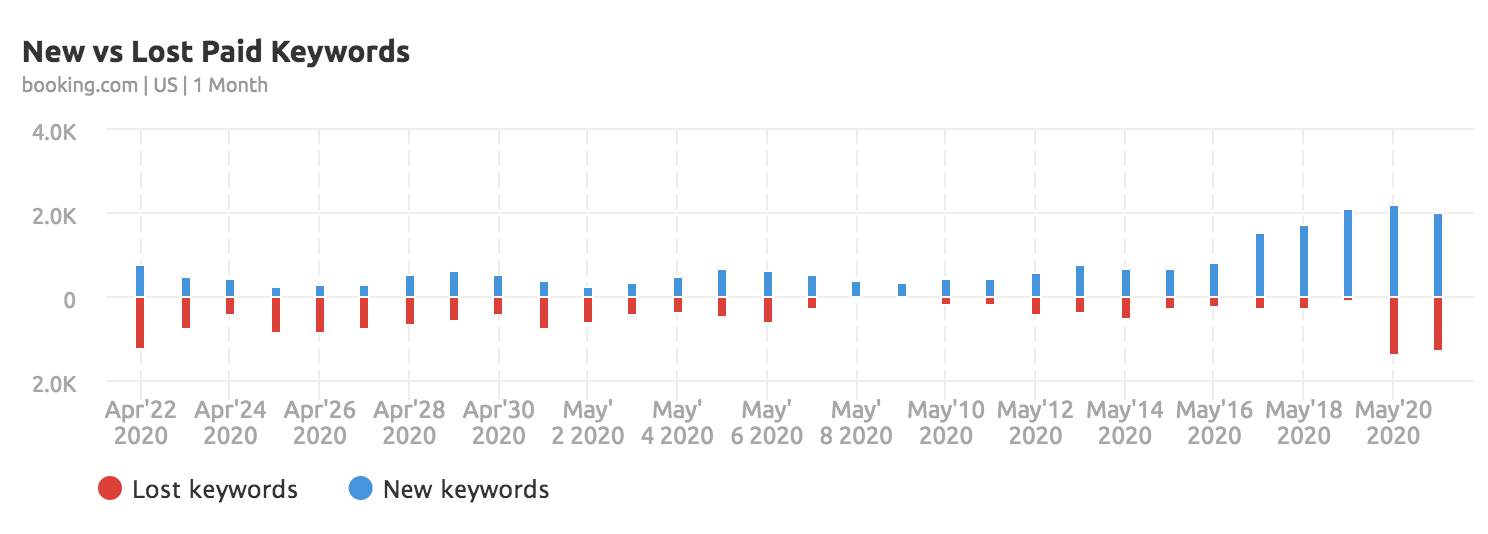

SEMrush has also recorded a 29% increase in paid keywords, which means booking.com is also expanding its reach. Their new keywords have jumped within the past two weeks. While they’ve also lost more keywords than in recent months, there’s still a pretty clear increase in paid activity since May 16 that hotels and resorts would do well to pay attention to—especially given that not all OTAs are on this path just yet.

Source: SEMrush

Because booking.com is still heavily invested in the paid advertising game, they’re coming out with some great data on U.S. travel trends. They reported that 71% of American users are searching for domestic travel, compared to just 58% of Americans at this same time last year.

Booking.com has also monitored travel wishlists, and noticed a 33% increase in domestic destinations being added to those lists. The top destination on the list? Orlando, Florida.

TripAdvisor.com

TripAdvisor.com is one of the OTAs that fell off of the competitive positioning map. While booking.com continued to dominate, TripAdvisor faded away. Their paid search summary clearly explains why.

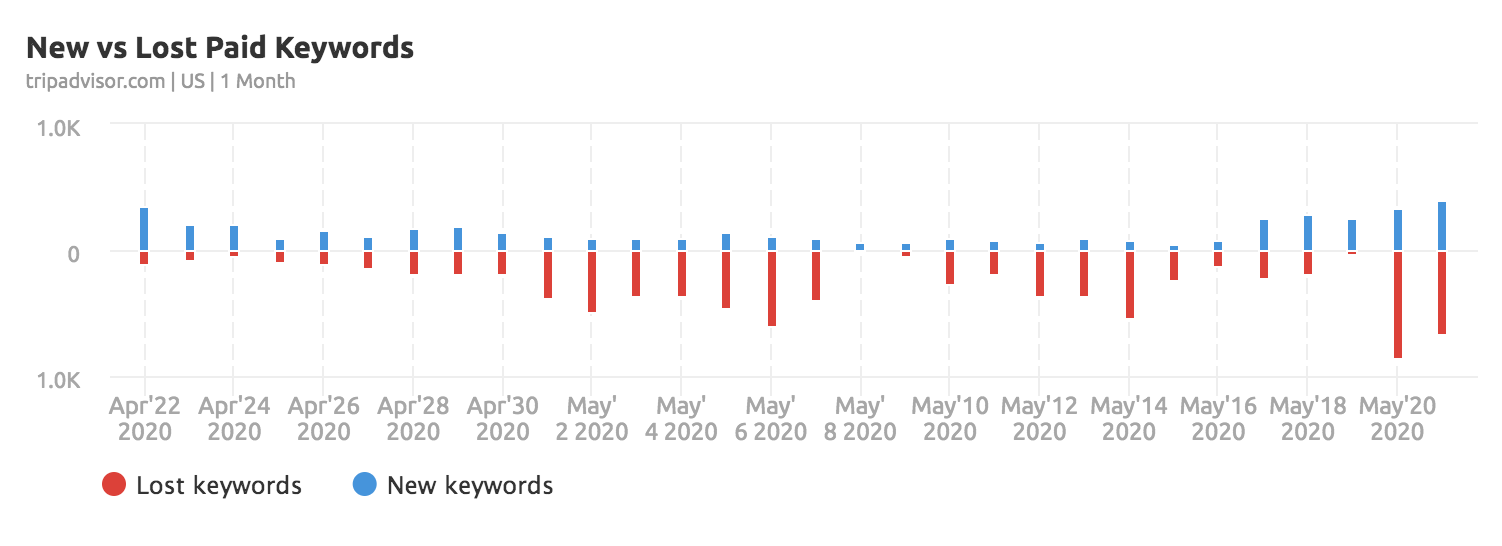

TripAdvisor’s traffic cost actually dropped by 37% in the past month, meaning they likely withdrew some of their budget during May. Their paid traffic fell 16% as a result. They’re also only bidding on 5,000 keywords, which is a 17% drop over the past 30 days. The minuscule uptick at the end of the graph suggests that TripAdvisor could be preparing for a comeback, but it’s too early for that to be conclusive.

Source: SEMrush

TripAdvisor has also continued to lose more keywords than they’re gaining. This could suggest that they’re focusing on a smaller set of high-performing keywords, or simply be a reflection of their likely reduced budget. Since TripAdvisor does seem to be scaling back, this is a great time for hotels and resorts to sneak into the game if TripAdvisor is a primary OTA in their market.

Source: SEMrush

Organically speaking, through, TripAdvisor is actually seeing increases across the board over the past month. This may mean that they don’t have as much of a stake in paid media as Booking.com, or simply that they’re refocusing given coronavirus has probably impacted their revenues.

Source: SEMrush

Organic notwithstanding, the paid media trends for TripAdvisor may also hint at deeper troubles for this OTA. HospitalityNet reported that TripAdvisor has implemented sweeping layoffs and furloughs, and could be one of the brands that are worst-off following coronavirus. Why?

TripAdvisor in Trouble

Simone Puorto, founder of Travel Singularity, wrote that “the metasearch market share of TripAdvisor dropped dramatically over the last 15 months.” Based on this statement, TripAdvisor’s viability may have been in question even before the pandemic.

TripAdvisor insiders commented to Puorto that TripAdvisor has always been something of a follower, responding to threats from others in the travel marketing space. They became more of a social media network to compete with Facebook. They also started up in meta to keep up with Trivago.

Another insider commented that they doubt TripAdvisor will make it another six to nine months if the outlook for the travel industry doesn’t improve. Should this come to pass, how can your hotel or resort rise up to fill that potential gap in impression share?

Hotels.com

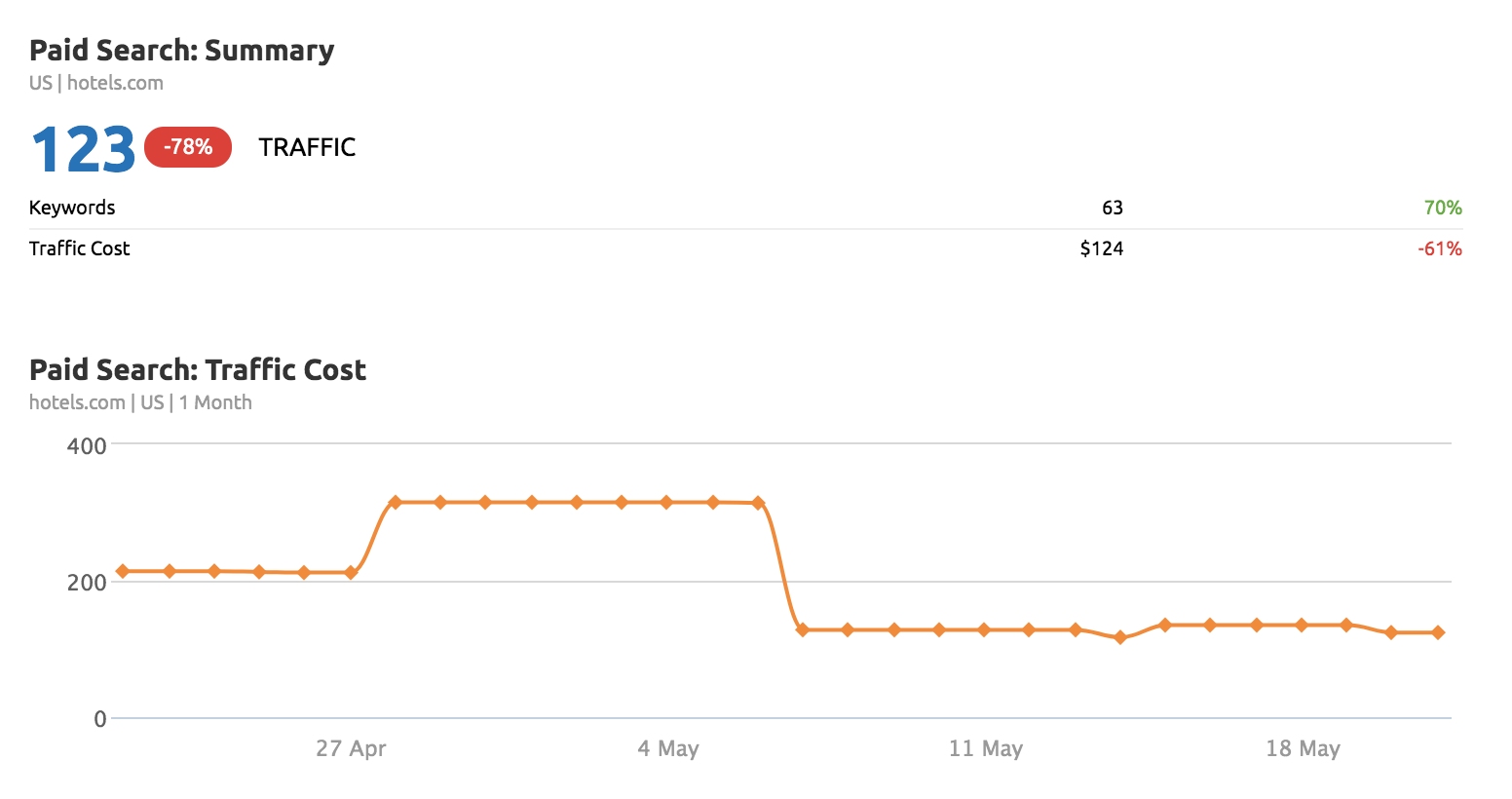

Hotels.com has been largely absent from the paid media marketplace. Their traffic is down 73% month over month, but they’re also only bidding on 63 keywords. Though that is a relatively small number of keywords, it’s still a 70% increase over last month, despite the fact that their traffic cost is still down.

Source: SEMrush

Their new and lost keywords reflect this same approach to paid media. They haven’t lost many keywords. They just don’t seem to be bidding on many in the first place—and haven’t for quite some time. This may be about a coronavirus-caused decrease in budgets, but it might also be part of their overall strategy.

If you take a look at their organic traffic, they’re only 2.73% down from April. Hotels.com has actually generated about 4 million more users via organic traffic than they did in March 2020. Their total organic traffic as of May 2020 reaches almost 35 million people. So it’s possible that their lack of showing in paid traffic is actually because Google Ads may not be their bread and butter.

Hotels and resorts who don’t have the budget to compete with bigger brands should take note. To put this in perspective, even though booking.com is blowing them out of the water in paid, booking.com is only recording 14.3 million users via organic traffic. So who’s really in the lead?

Source: SEMrush

Hotels.com is also making news for different reasons than other OTAs. They’ve offered rewards like double stamps on stays now through August 2021. Hotels.com is also going after the 96% of engaged couples who report that they’ll reschedule their weddings, encouraging couples to apply to be married online by the Hotels.com mascot. Selected couples will also receive $5,000 towards a post-coronavirus honeymoon.

It remains to be seen whether these tactics will pay off, but they’re still an interesting signal for Hotels.com’s perspective on where the business opportunities may exist for the travel industry.

Expedia

Until recently, Expedia had fully dropped out of the Google Ads marketplace. They only reintroduced some bids as of the past week.

Even with these increases, their estimated traffic cost is only about $25,000. This is really just a drop in the bucket compared to Booking.com’s $10.2 million. However, the fact that they have finally reintroduced Google Ad spend could be a signal for hotels and resorts who often find themselves coming up against Expedia.

Source: SEMrush

Their new vs lost keywords report reflects much of the same. They gained keywords as of May 18, which is also when SEMrush recorded a marked uptick in traffic cost. Clearly, Expedia got back in the game as of May 18. How long they stay in the Google Ads game and at what cost level remains to be seen.

Source: SEMrush

However, like Hotels.com and TripAdvisor, this may simply reflect Expedia’s preference for organic search. Over the past six months, they’ve increased the number of organic keywords they rank for by 4.58%. Their organic traffic has likewise increased by 8.65%. Expedia’s upward trajectory in organic search doesn’t seem to have changed much following coronavirus. If anything, they seem to have stayed the course.

Source: SEMrush

Expedia’s emphasis on organic traffic may be foreshadowing of things to come in the marketing world. Expedia Group CEO Peter Kern told CNBC on May 22, 2020, that he sees Google as a problem for anyone trying to generate revenue online.

Expedia Moving Away from Performance Marketing

Google’s own plays for revenue are taking up more and more space on Google-owned properties. This squeezes out even travel industry giants like Expedia. As a result, Kern actually wants to rely less on Google and performance marketing, noting that they need to do more work in gathering data across all their brands.

Kern told CNBC, “We just haven’t been as good on some of the basic blocking and tackling things that allow you to rely less on Google. And so we’ve used Google and performance marketing as our primary lever of whether we could grow at a certain rate or not, but we haven’t been great at merchandising, we haven’t been great at understanding the customer. We never had data across all our brands to understand if a customer had been at another of our brands and moved to a different one. We often competed in performance marketing auctions, our own brands against themselves. So we have a lot of our own work to do and to my eye, that means we have a lot of upside that is fully not reliant on Google or performance marketing.”

Pay attention to this anti-Google sentiment in the coming weeks and months. Google could actually soon be facing an antitrust lawsuit from regulators regarding their dominance in digital marketing.

Conclusion

Booking.com, TripAdvisor, Hotels.com, and Expedia are all travel-industry heavy hitters in their own right. Yet their varied performance shows that there’s more than one way to round the bases. Few hotels or resorts would argue that these brands are anything but powerhouses when it comes to the travel industry. Yet they all have a unique way of getting there. Rather than modeling your own property’s strategy after our suppositions of their strategies, instead take their positioning as lessons.Booking.com clearly relies heavily on paid media, and that was once also a viable approach for many hotels and resorts. Yet the other three show that you can find success by emphasizing other channels, whether that’s organic traffic alone, or media plays like Hotels.com’s offer to engaged couples. Expedia may even be preparing to shirk Google altogether.

Your hotel or resort is as unique as each of these OTAs. Treat your approach to marketing as such, even as coronavirus feels like it’s forcing you to take the walk to first. There’s another perfect pitch coming, you just have to know what you’re looking for.

Need help customizing a strategy to your property’s unique needs? Get in touch.

Did you enjoy the read?

Get original hospitality industry insights delivered to your inbox. Sign up to receive Screen Pilot’s Weekly COVID-19 Resource Center Update.