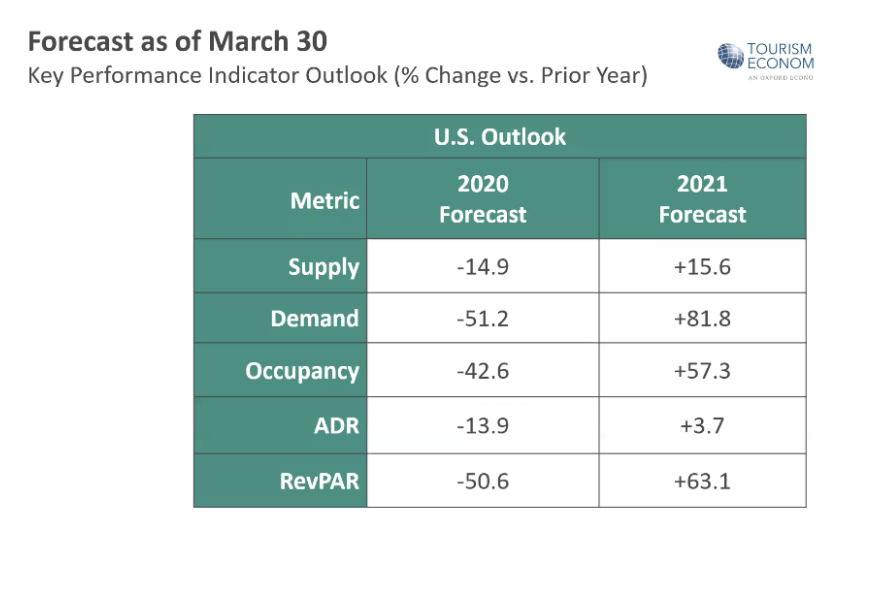

Times are changing fast, and it’s safe to say the initial projections for 2020 occupancy and RevPar have gone out the window. The U.S. hotel industry is projected to report a 50.6% decline in revenue per available room (RevPAR) in 2020. Even prediction models for COVID-19 peaks have been adjusted as we gather more information and more states implement stay-at-home ordinances.This article covers the key sources we’re using to try understanding forecasted RevPar and occupancy for the rest of the year and into 2021.Important reminder: all forecasts are based on the information we know right now. Every recession or major event that has impacted the industry will behave a little differently.

Hospitality Overview

Both STR and CBRE have a steady pulse on changes within the industry. With data filing into their systems daily, their projections show a reasonable picture of what the rest of 2020 will bring.While both STR and CBRE have forecasted occupancy and RevPar to decrease significantly this year, outlooks for 2021 are optimistic. Adam Sacks, president of Tourism Economics says, “Once travel resumes, the combination of pent-up travel demand and federal aid will help fuel the recovery as we move into the latter part of this year and next year.”

While supply and demand may rebound quickly, RevPar may take longer to recover. Historically, it took 24 to 36 months for RevPar to stabilize to previous levels after 9/11 and other economic recessions. These patterns give us a general expectation of what the future may hold, but different external factors, like COVID-19 cases completely fading away, will determine how soon we’ll see RevPar bounce back to pre-COVID levels again.Just like the COVID-19 outbreaks, recovery will come in waves depending on various factors, such as when and if a state-ordered a stay-at-home policy or the number of testing kits available. Comparing occupancy levels in the United States to China, it appears the US is following a similar pattern. China, whose pandemic is about 7 weeks ahead of the US, is already seeing occupancy gains.

Specific to You: Occupancy + Demand in Your Market

Taking a more magnified look, there are specific sources you can use to gather data points that will help build a forecast. Since people may be timid to plan trips that require air travel, most of these tips focus on monitoring the local drive market.

- COVID cases in drive markets and top fly-in markets: Watch for consecutive decreases in the daily infection and death rates. A week of decreases is a good indicator that things are truly subsiding. At that time, restart advertising on a scaled-back budget so you’re ready for when people start planning trips.

- When travel restrictions are lifted: Most people may not want to venture far but there will be some that are ready to take a trip.

- OTA bookings: An increase in OTA bookings coming in is a clear sign people want to travel and it’s time to turn your ads back on to compete for direct bookings. Have a strong pulse on what timeframe users are shopping for. Is it immediate? Or later in the year? This will help craft packages and promotions that match when users are looking to stay at the property.

- Increase in the search volume of words related to your property: Monitor both brand terms as well as top unbrand keywords that historically brought valuable traffic and bookings. Google Trends is a useful tool for tracking changes in search demand; here are some tips we’ve compiled for how to use this resource to monitor search volume as the COVID-19 pandemic develops.

- Increase traffic to your website as well as an increase in look to books: an uptick in browsing and shopping behavior is always a positive indicator, but especially in a world fraught with fear surrounding travel. Establish your critical KPIs for what these increases are and monitor them closely so you can take action should you see consistent increases over at least three to five days.

In summary, having a constant pulse on both the digital landscape and the climate of COVID-19 will help narrow down a timeline for implementing recovery strategies. With so much uncertainty, it’s important to develop those strategies now to ensure you’re prepared for the eventual influx of website traffic and interest in your property and guarantee you’re not behind when travel interest picks back up.

Did you enjoy the read?

Get original hospitality industry insights delivered to your inbox. Sign up to receive Screen Pilot’s bi-weekly COVID-19 Newsletter.