Updated on Tuesday, April 21.We have seen a lot of changes in OTA activity just over the last week. Expedia.com is showing little-to-no spending activity since April 13. Hotels.com seems to be following a similar trend—our reports indicate they’re showing for minimal paid keywords on 4/19.While other OTAs are still spending to some degree, they have definitely continued to scale back. Booking.com appeared to be bidding on ~30k keywords on 4/15 – but now on 4/21, they are only recorded to be bidding on 17.7k keywords – almost half as much as the previous week. This suggests that search volume has also, most likely, continued to drop, as many of these keyword variations are created by bidding on broad match terms.While it seemed that OTAs were originally going to keep budgets on during the pandemic, it seems that the reality of the situation might be starting to show as they now scale back. I believe the next two weeks will be pivotal for getting an idea of what their strategy will be for the foreseeable future.At Screen Pilot, we will continue to monitor closely what the major players of the advertising industry – specific especially to the travel industry – are doing during this period and strategize appropriately.———————————————————————————————————————————————————————If you work with hotels and resorts, chances are the competitors you’re most often angling to overcome aren’t actually other hotels. It’s Online Travel Agencies (OTAs). Love them or hate them, competing with OTA’s has become a critical component of many hotel’s media strategies. They can be both a motivator to up your hotel’s paid media game, or even a benchmark for whether or not your own efforts meet the industry standard.Since many brands and individual properties have adjusted their digital media due to the ongoing COVID-19 crisis, we here at Screen Pilot wanted to know what actions OTAs were taking, and if there were any learnings to incorporate into hotel and resort paid media strategies.The following estimates for OTA media spends were generated by SEMRush during the weeks leading up to COVID-19 through to the present. These are our four key takeaways that hospitality marketers need to know.

Takeaway #1: OTAs are spending less — but they’re still spending

To no one’s surprise, OTAs have significantly decreased their spending. Some OTAs are only estimating a decrease of 20% while others are as high as 40%. But that means that up to 80% of these OTAs’ typical spend is still in the ads marketplace. So while they have scaled back, they are still prioritizing a strong presence of at least ~50% of their normal exposure. Depending on whether or not your property is still operational, it may be worth it to keep brand campaigns on, even at a low level. This will ensure that a) the traffic your hotel or resort does receive during COVID-19 doesn’t fall to OTAs by default and b) that you’re still acquiring any possible online bookings at the most efficient cost.

Takeaway #2: Some OTAs are expanding their keyword sets

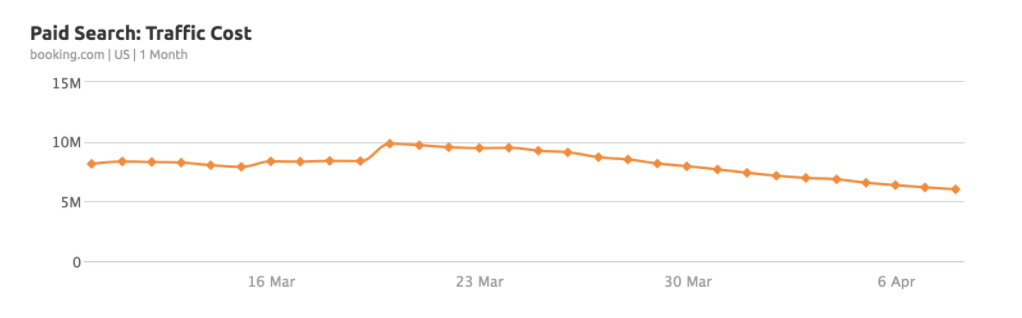

Not only have OTAs continued to advertise, but many have actually expanded their keyword sets. We noticed that OTAs increased the number of keywords they were bidding on between March 15 – 20, the days immediately following the U.S. declaring a National Pandemic. Specifically, Booking.com & Trivago implemented a major increase in new keywords and spend.

While we’re unable to see what the exact keywords were, it appears these OTAs saw an opportunity. A possible explanation could be that OTAs anticipated consumers being forced to change travel plans (for example: having to look for flights home, possible last-minute accommodations) and took this time to push non-refundable rates (which makes up around half of booking.com’s air travel business).For our advertisers, this not only tells us that OTAs are still active, but also actively changing strategy in response to developments with the COVID-19 crisis. For clients whose main OTA competitors are Booking.com or Trivago, it may be worth it to launch those branded and meta search campaigns where able.

Takeaway #3: Even OTAs know how important branded campaigns are

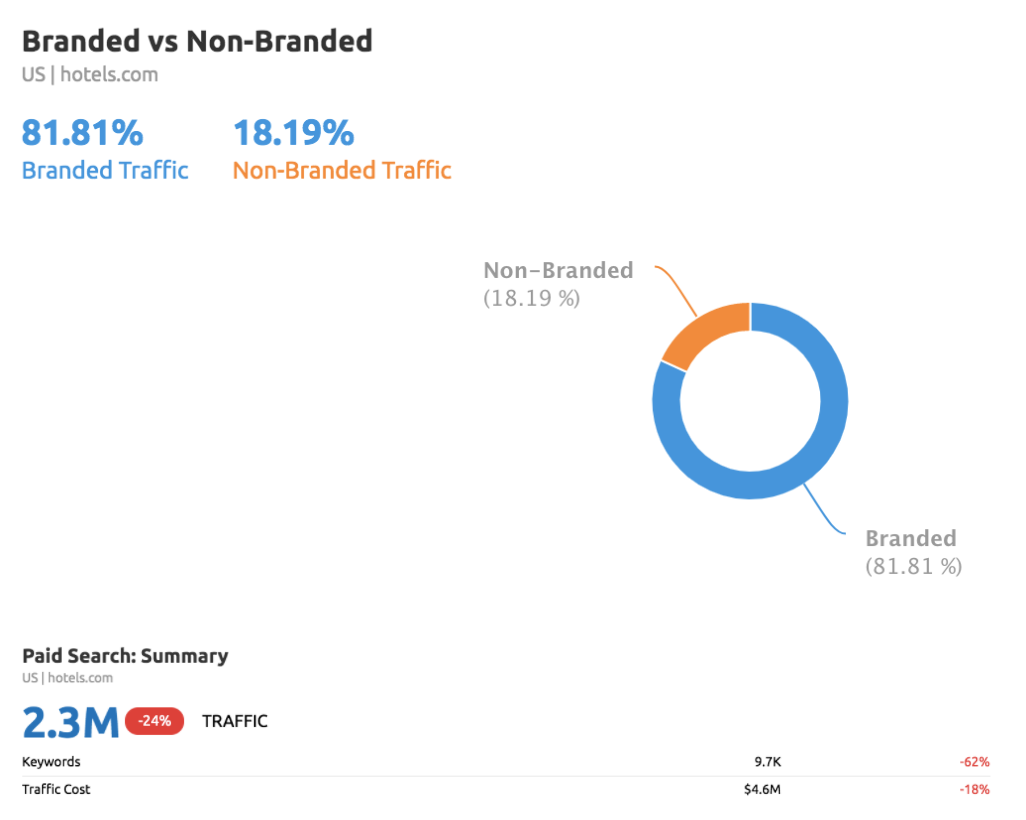

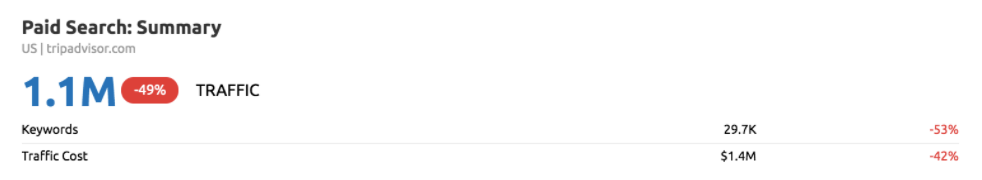

Not surprisingly, another trend we noticed is the power of brand searches and how even OTAs know how important it is to maintain a strong brand presence through uncertainty. Hotels.com receives over 80% of its traffic from branded searches. Once news of COVID-19 began to escalate, they scaled back their budgets around 56% but only saw a 20% decrease in paid traffic. Hotels.com’s strong focus on brand keywords allowed them to scale back, while focusing on revenue-driving campaigns. These findings tell us that even during crises, companies like Hotels.com that worked hard at promoting their brand previously can continue to reap the benefit even though they have scaled back spend.

Meanwhile, TripAdvisor, who receives less than 3% of their traffic from brand searches, experienced a much steeper decrease in traffic (43%). This indicates to us that now is the most important time to ensure that you are still keeping the light on for your own brand keywords to maintain high rank at the lowest CPC.

Takeaway #4: Beaches may be closed but people are still planning summer vacations

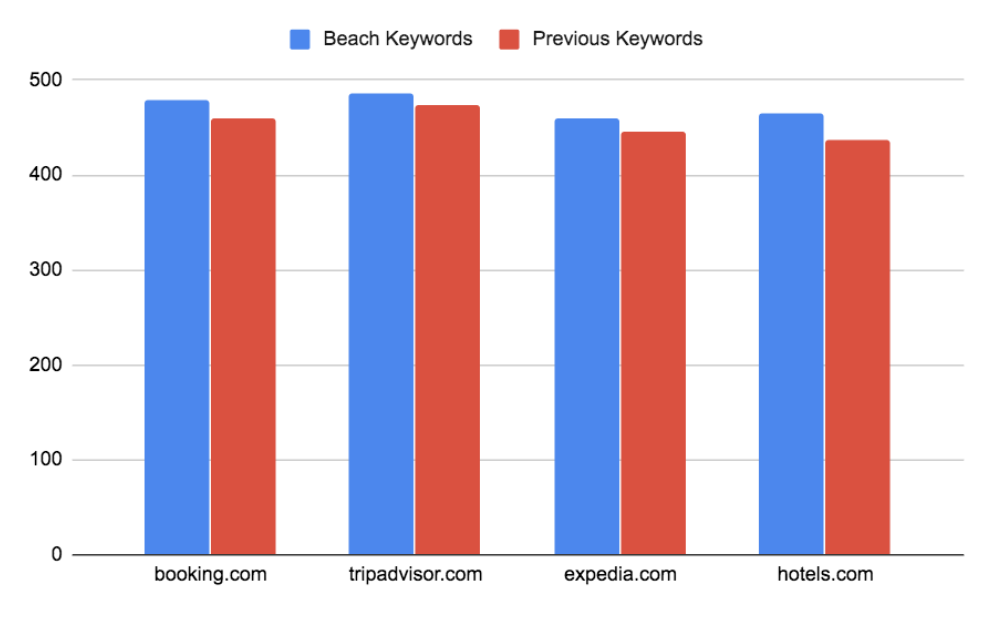

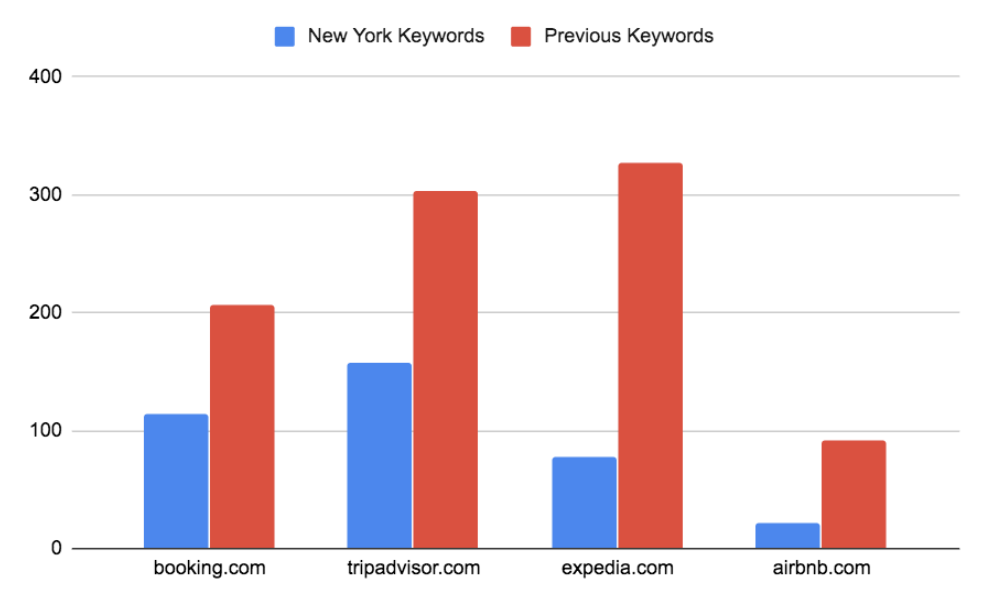

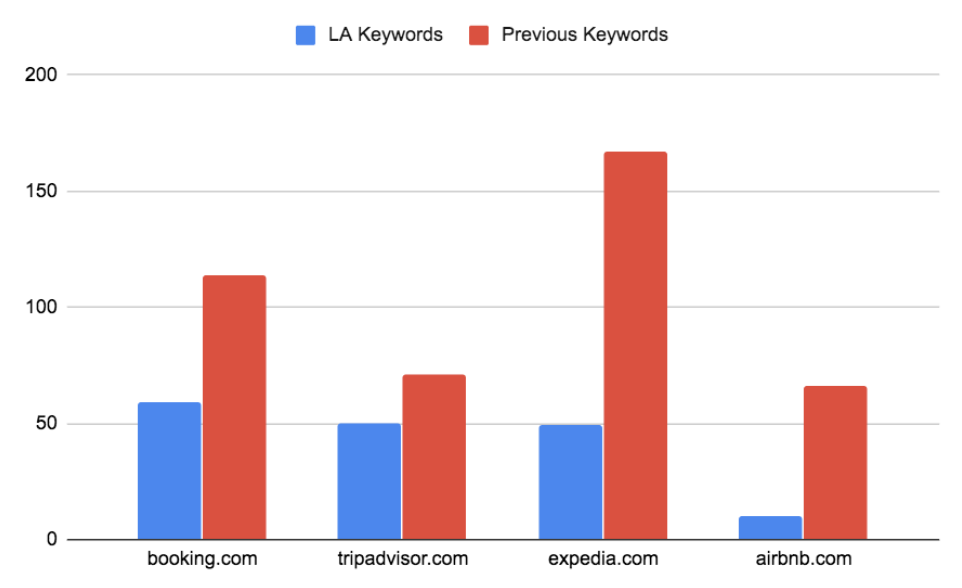

Finally, we were also interested to see if OTAs were changing their strategy by bidding on different themes or geos. Taking a look at the Seattle, Los Angeles, and New York related keywords OTAs are bidding on (report: April 13 vs March 15) tells us they have pivoted from these highly-affected markets and are focusing their budgets elsewhere. However, they are still maintaining some presence for all of these markets.One area in which we noticed some increases month-over-month was beach-related keywords. This tells us that even though beaches are closed right now, people are still planning and searching for beach vacations in anticipation of travel restrictions being lifted in time for summer. The top beach locations all OTAs seem to be bidding on are Myrtle Beach, Clearwater Beach, Panama City, Miami, and Orange Beach in Gulf Shores. For our beachfront advertisers, this is indicative that digital advertising is still needed at this time since consumers are searching and fine-tuning their messaging to promote stays further out may be a better strategy than going dark with media.

In summary, OTAs are still active and changing their paid media strategies as the COVID-19 crisis develops — taking huge advantage of the shopping from home consumers (versus work, let’s face it) – and you should be too.

Did you enjoy the read?

Get original hospitality industry insights delivered to your inbox. Sign up to receive Screen Pilot’s COVID-19 Resource Center & Data Dive Newsletter.